SVTR Weekly #131

From a $60B valuation to a $2.3B Series C: AI investing enters a supercycle. Who’s in pole position?

Weekly Briefing

Global AI venture activity went full throttle this week. Across check sizes, category breadth, and founder backgrounds, the market showed extreme bifurcation: top-tier valuations ripping higher, unprecedented capital density in infra, model-layer gravity tilting toward giants, and application-layer companies pushing harder on commercialization.

At the same time, the capital map is crystallizing into a U.S.–Middle East–China tripod. The new AI founder archetype blends top research talent, big-tech operators, the defense ecosystem, and repeat entrepreneurs.

On the ground, community conversations focused on pragmatic themes—turning from pure “go-global” to a dual-track playbook and planning for “re-growth.” Stanford’s session on “How AI is reshaping VC,” plus next week’s talk on Asian LLMs, add fresh angles to this global AI sprint.

1) Notable Deals

Thinking Machines Lab — founded by former OpenAI CTO Mira Murati — is in early talks with multiple global blue-chip investors for a new equity round at a $50–60B target valuation. That’s more than 4× the $12B seed valuation the company reportedly closed in July 2025, which would place it firmly in the top tier of private AI companies by value.

Lovable (Stockholm, 2024) offers an AI dev platform that builds apps and websites through “vibe coding” in natural language. The company is negotiating a new round at a $6B target valuation; $215M raised to date.

Neura Robotics (Metzingen, 2019) develops cognitive and humanoid robots for manufacturing, logistics, and consumer use. Reports indicate a new raise of about $1.2B (≈ €1B) led by Tether under discussion, implying an €8–10B valuation (≈ $8.8–11B). Cumulative funding exceeds $200M.

Sources: SVTR.AI

2) VC Focus

Data from the AI venture tracker points to an unusually “barbell” week:

Mega-rounds everywhere; capital density hit a quarterly high.

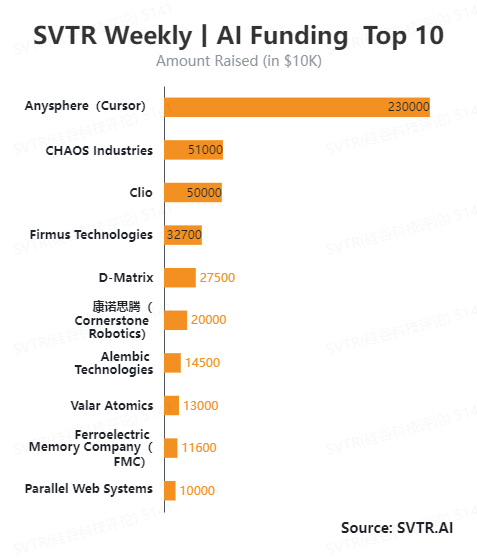

– Anysphere closed a $2.3B Series C, resetting the ceiling for software startup valuations.

– CHAOS ($510M Series D), Firmus ($327M), and others continued to lift the tide for models and infra.Breadth across the full stack: infra → models → apps.

Energy, compute, chips, AI agents, legaltech, biotech, robotics, defense/security, ad systems, industrial automation—nearly every high-moat niche saw representative financings.Geo spread is clear: U.S. leads; Israel, China, Europe each break out.

– U.S. accounted for >72% of deals; full-stack AI remains concentrated stateside.

– Israel surged in security and systems-infra.

– China broke out in embodied intelligence, DPU chips, and AR hardware.

– Europe shined in AI storage and industrial automation (FMC, Euler, Forgis).

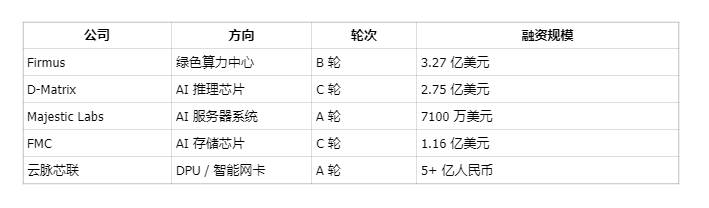

2.1 Infra Layer: Biggest rounds, hardest-core founders

Infra—especially chips, data centers, and power—was the most active band this week.

High concentration of nine-figure rounds.

Founder pedigrees skew to Stanford/MIT and Google/Meta/Broadcom alumni.

Multiple valuations now pressing up against $3B.

2.2 Model Layer: Highest valuations; winner-takes-most

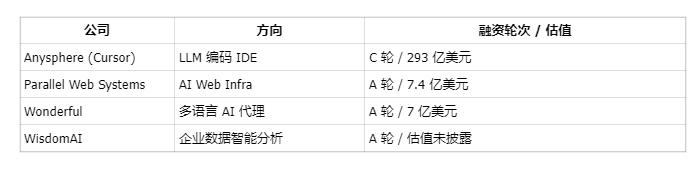

Anysphere (Series C $2.3B, valuation approaching $30B) pulled up model-layer medians.

Platform plays (e.g., Cursor, Parallel) drew heavy interest.

Clear “top-heavy breakout, mid-tier stall” dynamic.

Early-stage model rounds are evaporating as capital concentrates in a small set of scale-capable platforms.

2.3 Application Layer: Complex structure; vertical and platform plays in parallel

The app layer saw the most companies and the widest spread of directions, with a shift from tool-like MVPs to commercially closed-loop platforms.

Legal AI led app-layer check sizes: GC AI, Theo, Greenshoe each raised ~$50M-level rounds.

Enterprise: automation, SaaS, marketing, and collaboration lit up in pockets.

Healthcare/biotech AI: multiple $100M+ raises.

Embodied intelligence/industrial robotics: notable momentum out of China.

Defense/security: Israel-based startups continue to define the frontier.

3) Investor Landscape: U.S., China, and Sovereigns form a tripod

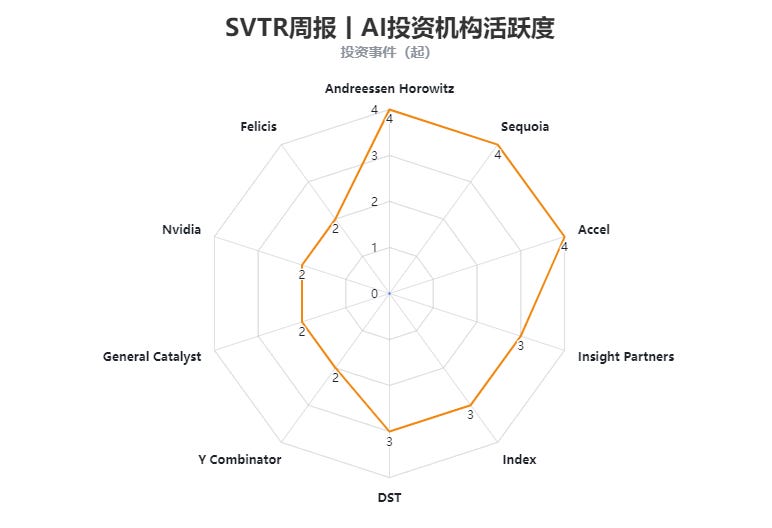

U.S. top-tier firms still dominate global AI deployment of capital. a16z, Accel, Sequoia, Thrive, Kleiner Perkins show up frequently across infra, model platforms, and enterprise AI tools.

Middle East sovereigns are now structural players. QIA and Mubadala exhibit strong appetite, with a tilt toward biotech, model platforms, and deep-tech.

China capital concentrates on the compute + embodied-intelligence chain. Firms like Qiming Venture Partners and Zhangjiang Haoheng focus on chips, autonomous robotics, and industrial intelligence—while largely sitting out overseas model bets.

4) Founder Archetypes: Five clear paths

Research-driven builders: academic + deep-tech backgrounds, biased to hard-tech (chips, biotech, medical, security infra). Core alma maters: MIT, Harvard, Oxford, Cambridge.

Ex-big-tech operators: product-led with fast GTM; backgrounds from Google, Meta, Replit, McKinsey; focus on enterprise, SaaS, and legaltech—areas with short paths to revenue.

Security/defense alumni: densest in Israel (e.g., Unit 8200, Akamai lineage); domains include cyber defense, data security, and mil-grade detection.

Repeat founders: investors favor high-retention playbooks and proven exits. Exowatt, Red Queen, Bindwell are examples led by second-time CEOs.

China-born founders: strong correlation with chips + robotics; roots in Huawei, Tsinghua, SenseTime; focus on embodied intelligence, vision operators, and industrial AI.

5) Community

On Nov 16, SVTR|Silicon Valley Tech Review hosted a closed-door meetup in Shanghai (Mosu Space) on “Anti-Outbound & Re-Growth under the Silicon Valley AI wave.” Dozens of frontline AI founders, operators, and investors from the U.S. and China joined.

Panels dug into low-altitude economy, spatial computing, AGI content infra, service robots, AI digital employees, and autonomous mining—debating how to balance global vision with China execution: when to shift from single-market “outbound” to a dual-engine strategy; how to split “build abroad / amplify at home”; and how to design KPI systems and leverage capital + industry partners for the re-growth stage.

In open networking, teams and funds matched on financing cadence, industrial resources, and cross-border collaboration—several agreed on concrete follow-ups. SVTR will extend this thread via its AI Venture Database, AI Venture Forum, and AI Venture Camp to connect U.S.–China and global AI founder networks.

SVTR Incubator has officially secured AWS Startup Credits support. Projects backed by SVTR may receive at least $10,000 in credits, stackable with AWS Activate.

6) Essential Read

How AI is Reshaping VC — from “what to invest, how to invest, who invests” to “how to use AI to invest.”

At last night’s Stanford AI and Investment Series, Mohammad Rasouli (building an end-to-end AI platform for funds) hosted a high-density discussion with Som (Greylock), John Whaley (Inception Studio), Will (Prime Unicorn Index), and Salil (independent investor).

From model-vs-app dynamics to indexation of private markets to AI-native fund workflows (sourcing, DD, portfolio ops, and fundraising), the session offered a crisp snapshot of how AI is hitting VC at the core.

7) Next Week

Date & Time

Tue, Nov 18, 2025 — 4:30–5:50 PM (PST)

Venue

Bishop Auditorium, Stanford University

Address: 518 Memorial Way, Stanford, CA 94305

Topic

“The Latest in AI and Large Language Models in Asia.”

A talk by Dr. Tatsunori Hashimoto (Assistant Professor, Stanford CS) on the latest innovations across Asia in AI and LLMs—and how technology development and geopolitics together shape the next phase of model evolution. Dr. Hashimoto’s research focuses on building robust, trustworthy ML systems, especially long-tail behavior, out-of-distribution reasoning, and bias mitigation in complex models.

Host

Dr. Richard Dasher, Director, U.S.–Asia Technology Management Center (Stanford).

Editor’s note: For more details, visit Silicon Valley Tech Review at svtr.ai.