AI Venture Watch | 2025 Q2: Capital Storm Meets Technology Race

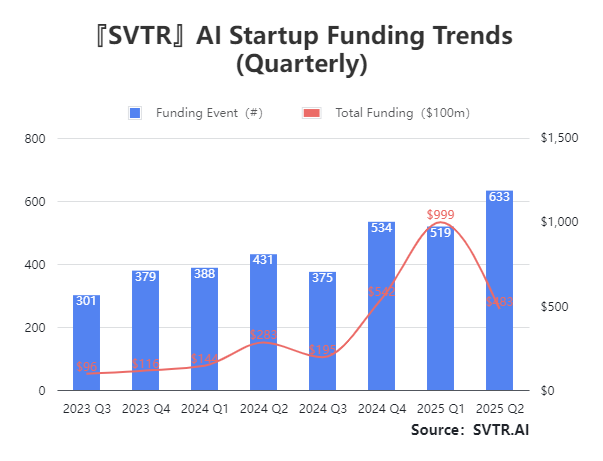

In the second quarter of 2025, the generative AI wave surged to new heights as capital and technology fused ever more deeply, driving an unprecedented acceleration across the industry. According to Silicon Valley Technology Review’s (SVTR) AI Venture Database, the first half of 2025 (Q1 + Q2) saw 1,151 global AI funding rounds totaling $148.1 billion. In Q2 alone, there were 633 deals worth $48.3 billion, marking the second-highest quarterly total ever recorded.

By focusing on a “large model + infrastructure + application platform” core, the AI ecosystem is rapidly maturing. Infrastructure financing jumped 87% quarter-over-quarter, making compute and data foundations the hottest new frontier. Meanwhile, more than half of Q2’s funded startups were founded after ChatGPT’s debut—founders now include FAANG engineers, interdisciplinary scientists, and vertical-market experts. Top global funds like Sequoia, a16z, and Y Combinator doubled down, ushering AI investing into a global, diversified new phase.

1. Global AI Funding Overview

In H1 2025, global AI startup funding heated up further: 1,151 deals (+41% YoY) raising $148.1 billion (+247% YoY). While Q2’s total dipped from Q1 (which was buoyed by OpenAI’s $40 billion raise), deal count hit a new record, underscoring investors’ enduring confidence in AI.

Record Deal Volume. Since Q4 2024, quarterly deal counts have stayed above 500; in Q2 2025 they topped 630.

Funding Concentration Fluctuates. Q1 saw nearly $99.8 billion—its highest since early 2023—driven by mega-rounds in the model layer.

Diffusion Effect. In Q2, average deal size scaled back 52% QoQ as funding spread to more early- and mid-stage startups.

Daily Averages Soar. H1 2025 averaged $820 million funded per day—over three times H1 2024’s $230 million—and saw 6.4 startups secure financing daily.

2. Portrait of AI Startup Funding

2.1 By Technology Layer

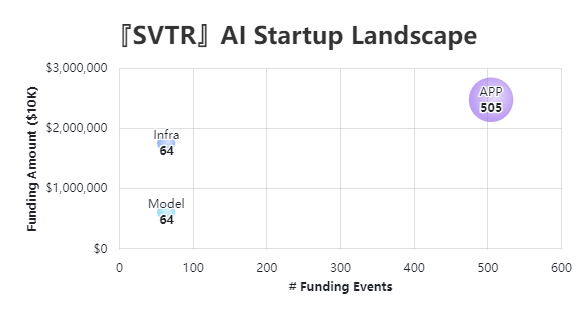

In Q2 2025, 633 AI funding events raised $48.3 billion. Generative applications still dominated deal count (~80%), but the tide is turning: infrastructure funding surged, nearly matching applications in total dollars.

Applications (≈80% of deals). Tools, platforms, and vertical AI services continue to attract the most rounds.

Infrastructure. Compute and data foundations saw an 87% jump QoQ.

Model Layer. Funding fell 76% QoQ, though average round sizes remain 5–8× larger than other segments.

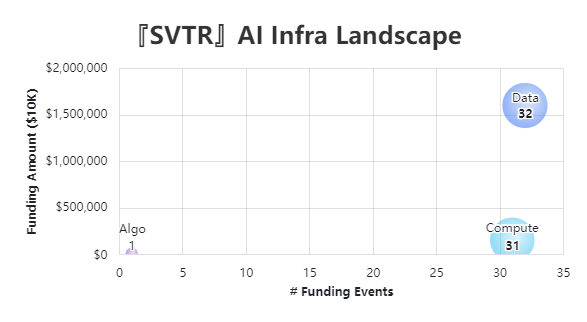

2.2 Infrastructure Layer

Data Services (32 deals, ≈ $15 billion). Demand exploded for training datasets, privacy-preserving compute, and compliance tooling.

Compute (31 deals, ≈ $2 billion). Cloud GPU clusters, liquid-cooling servers, and chiplet interconnect accelerators led the way.

Algorithm Frameworks (1 deal, <$100 million). Next-gen distributed schedulers and compiler optimizers began attracting early capital.

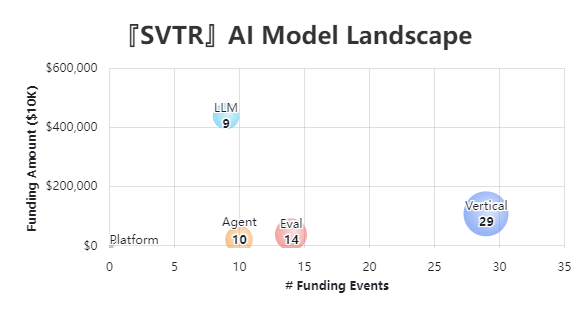

2.3 Model Layer

Large model funding cooled: average deal size fell 40% QoQ, yet remains the highest among all segments. Meanwhile, verticalized models and intelligent agents racked up smaller, more frequent raises, driving deal count.

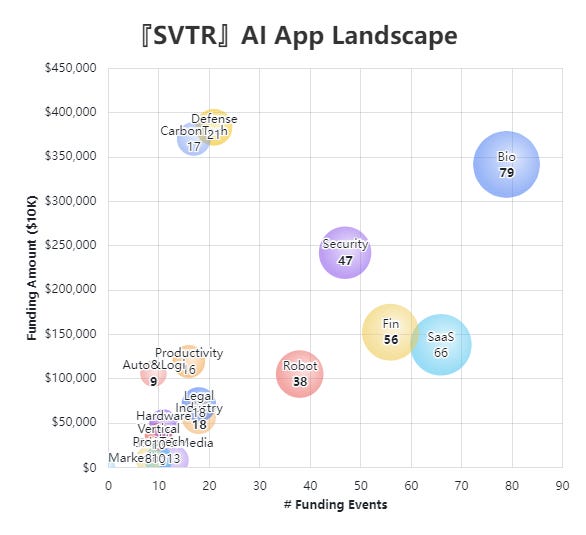

2.4 Application Layer

Life Sciences & Enterprise Services. Life sciences startups led average deal size 3× above the mean.

Defense & Security. Policy tailwinds pushed per-round investments above $500 million, placing defense companies in the top three by dollars raised.

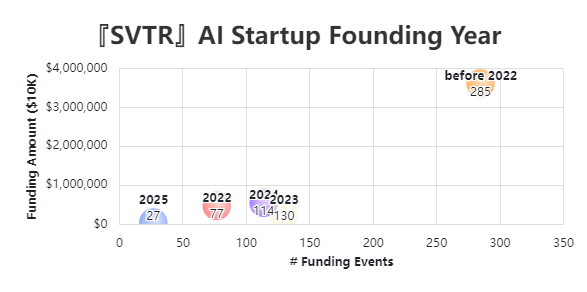

2.5 Founding Cohort

A whopping 107 “post-ChatGPT” ventures (founded within the last year) secured funding—17% of total deals. While headline-grabbing unicorn raises grab headlines, most of these newcomers are scaling carefully from seed- and Series A rounds under $100 million.

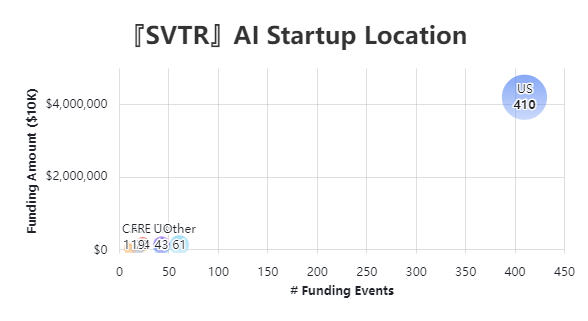

2.6 Geographic Distribution

United States. Still dominant, capturing 87% of capital and over 400 deals—1.3× last year’s Q2 volume.

China & UK. Tied for second in deal count. Notably, over 100 founders of Q2 rounds have Chinese heritage overseas, reflecting active global diasporas.

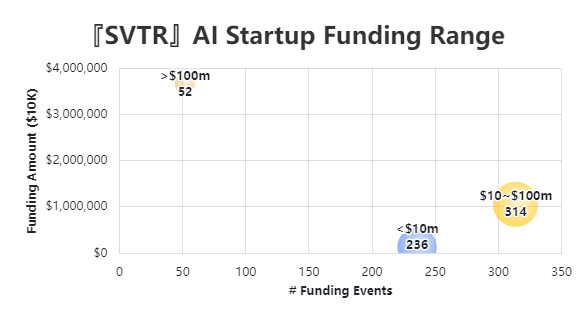

2.7 Deal Sizes

$10 M–$100 M. Accounted for 60% of all rounds.

Mega-Rounds. 67 deals exceeded $100 million; 7 ever-larger raises topped $1 billion.

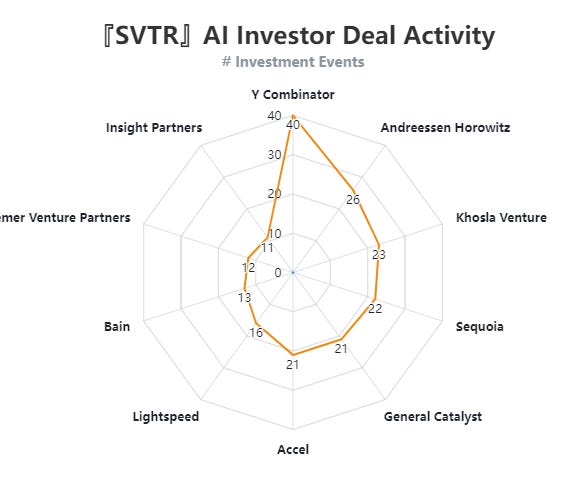

3. Top AI Investors

In Q2 2025, the ten most active AI investors collectively led 252 deals, spanning seed to Series D, with a strong tilt toward infrastructure and enterprise services.

Frequency Up. YC, a16z, and Sequoia increased quarterly deal flow by 59% on average.

New Entrants. Insight Partners, Accel, and Benchmark cracked the top ten, signaling more large-scale funds entering AI.

Shift in Focus. Compared to Q1, more capital trended toward security/compliance and enterprise Copilot offerings, while mega-round infrastructure deals were confined to a handful of mega-funds.

Bigger Cheques. Top 10 average check size jumped 29% QoQ to $22 million; 14 rounds saw syndicates write checks above $50 million.

Regional Diversification. U.S. share of deals dipped from 72% to 68%, with Europe (France, UK, Germany) plus Israel rising to 22%. Early-stage projects also emerged in India and Latin America.

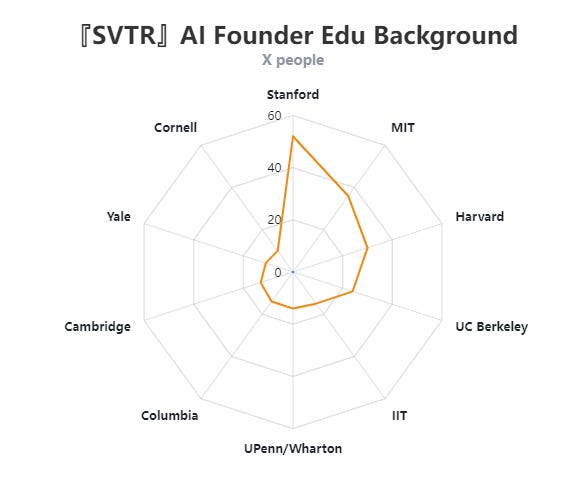

4. AI Founders

Q2 funded founders encompassed over 1,200 individuals—up markedly from Q1. Two key trends emerged:

Big Tech Alumni. Google, Microsoft, and MIT labs remained the top talent feeders (33% combined); Meta slipped to fourth, hinting at a slowdown in social-platform talent exodus.

Elite Academia. MIT grads now trail only Stanford, followed by Harvard and UC Berkeley; IITs and Ivy League schools (Cornell, Yale) continue to contribute steadily.

5. Top 10 Q2 Financing Highlights

Scale AI (2016, San Francisco) raised $14.3 billion from Meta at a $30 billion valuation—Meta’s largest external investment ever.

Anduril (2017, Costa Mesa) closed a $2.5 billion D-round co-led by Founders Fund, valuing the defense AI specialist at $30.5 billion.

Thinking Machines Lab (2024, San Francisco) raised $2 billion seed from a16z, Conviction Partners at a $10 billion valuation.

Safe Superintelligence (SSI) (2024, Palo Alto & Tel Aviv) secured $2 billion Series A from Greenoaks at a $32 billion valuation.

TAE Technologies (1998, Foothill Ranch) added $150 million growth funding from Google, Chevron, NEA.

Grammarly (2009, San Francisco) completed a $1 billion non-dilutive round with General Catalyst.

Commonwealth Fusion Systems (2018, Devens) closed $1 billion from a major cloud provider.

Anysphere (2022, San Francisco) raised $900 million Series B led by Thrive, a16z, Accel, DST.

Helsing (2021, Munich) secured $693 million Series D from Prima Materia, General Catalyst, Saab, Accel.

TerraPower (2006, Bellevue) raised $650 million from NVentures, Bill Gates, HD Hyundai.

About SVTR

Silicon Valley Technology Review leverages our AI Venture Database, weekly AI investor roundtables, and intensive “AI Venture Camp” to forge a community-driven incubator. Visit us on SVTR.AI for deeper analysis, or add us on WeChat: pkcapital2023.